Think about what happens when you go to buy a car. To help close the sale the car dealership automatically includes several different creative financing options – leasing, low interest loans, longer payment periods, etc. You naturally consider all these options as you make your buying decision. We have reached a point where we expect the dealership to be knowledgeable about these options and help us apply for the best choice once we make a decision. Unfortunately, the energy efficiency sales industry is so fragmented that there is no common market model - like the car dealership industry – to systematically present financing options right when the customer is trying to make a purchasing decision.

In May, I had the opportunity to participate in the 2017 ACEEE (American Council for an Energy-Efficient Economy) Energy Efficiency Finance Forum in Chicago. This event has been around for more than a decade and no matter how many new ideas around financing energy efficiency projects are discussed and innovated, there never seems to be significant traction in how to create a scalable solution. Multiple studies continue to show approximately 40% of commercial projects do not move forward because of lack of funding.

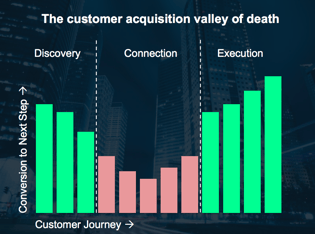

Image Credit: Joe Indvik, Rock Creek Consulting. ACEEE Finance Forum Presentation

Image Credit: Joe Indvik, Rock Creek Consulting. ACEEE Finance Forum Presentation

One session I attended really drove this point home when they highlighted the fact that there is a “wealth” of supply (i.e. Capital) and a huge demand ($340 Billion estimated need over the next ten years) …so why isn’t the law of economics working??? The conclusion they reached was that we have a “customer acquisition valley of death” – (credit to Joe Indvik of Rock Creek Consulting for presenting the concept). In plain English, the point being made was that are lots of ways for customers to learn about financing options (i.e. Discovery Phase) and once a financing proposal is presented, the likelihood of moving forward goes up (i.e. Execution Phase). But, what is missing is a scalable way for customers to actually understand their financing options when they are making a purchasing decision (i.e. Connection Phase).

Other sessions continued to build on this question with one solution that may hold the answer – utility rebate programs. Utility rebate programs have built trade ally networks that train local and regional energy efficiency companies to present rebate options to customers as they are making their buying decision. Rebates are a form of financing (everyone wants free money…right?) so why not also offer financing for the remainder of the project cost at the same time? Encentiv Energy is currently working on a pilot with a utility and a 3rd party financing company to offer multiple financing options through the utility’s trade allies. Early indicators show that customers are responding favorably to this simplified and scalable model. We will keep you posted... If you're interested contact us to learn more.

.png?width=500&name=2019%20e%20news%20spotlight%20logo%20(1).png)